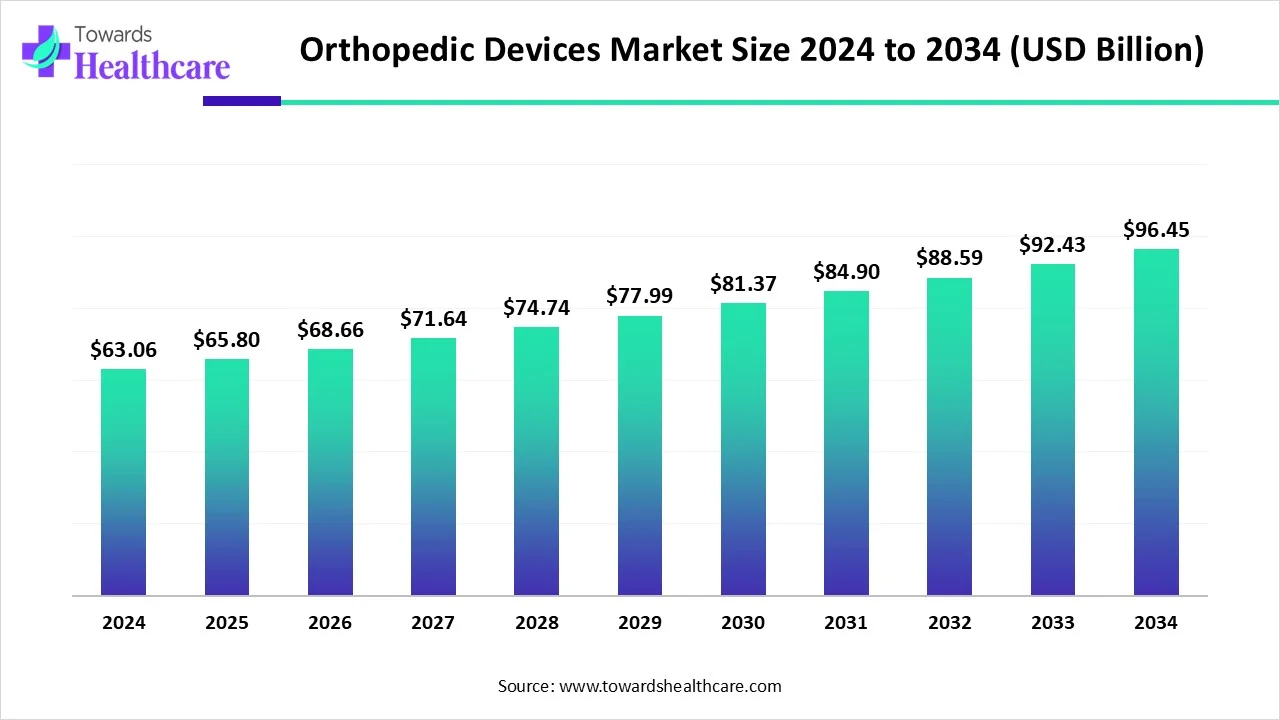

Orthopedic Devices Market Size Expected to Reach USD 96.45 Billion by 2034

The orthopedic devices market size is calculated at USD 65.8 billion in 2025 and is expected to reach around USD 96.45 billion by 2034, growing at a CAGR of 4.34% for the forecasted period.

Ottawa, Oct. 03, 2025 (GLOBE NEWSWIRE) -- The global orthopedic devices market size was valued at USD 63.06 billion in 2024 and is predicted to hit around USD 96.45 billion by 2034, rising at a 4.34% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5721

Key Takeaways

- Orthopedic devices industry poised to reach USD 63.06 billion in 2024.

- Forecasted to grow to USD 96.45 billion by 2034.

- Expected to maintain a CAGR of 4.34% from 2025 to 2034.

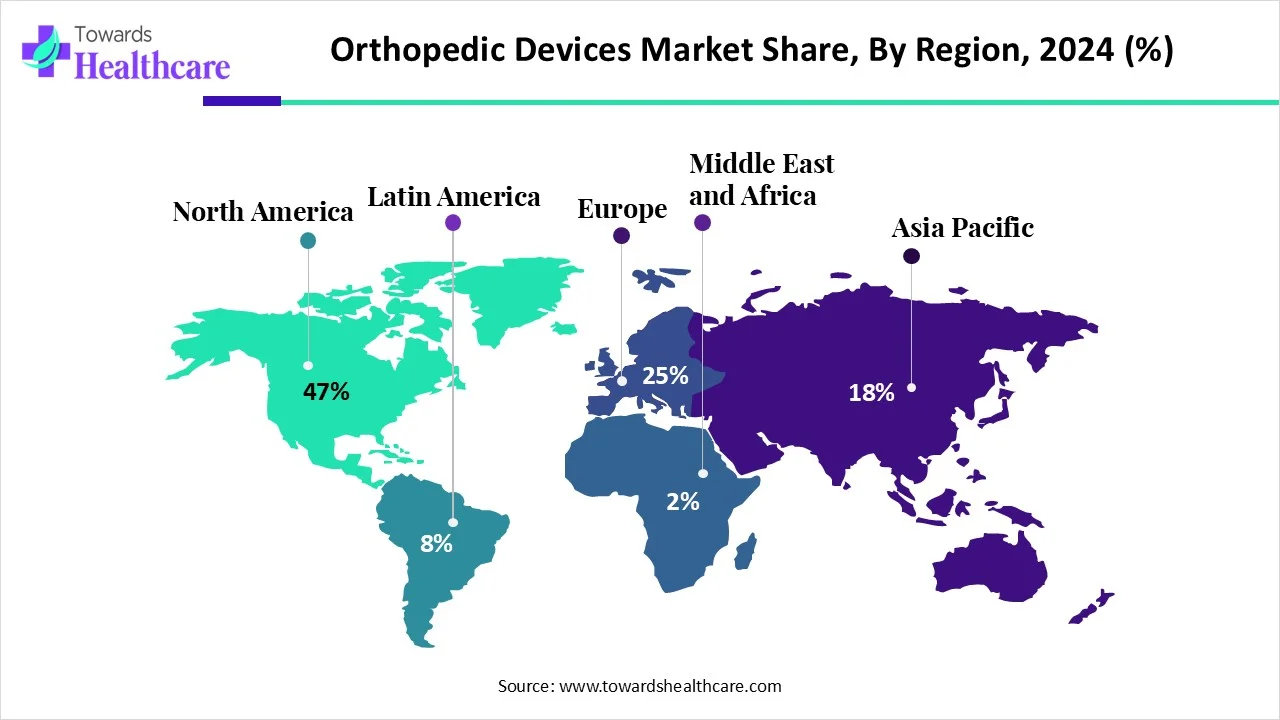

- North America was dominant in the orthopedic devices market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By product, the joint replacement/orthopedic implants segment led the global market in 2024.

- By product, the orthobiologics segment is expected to be the fastest-growing during the forecast period.

- By end-use, the hospitals segment held a major share of the global market in 2024.

- By end-use, the outpatient facilities segment is expected to register the fastest growth in the studied years.

What are the Orthopedic Devices?

Medical devices that are employed in the diagnosis, treatment, or management of musculoskeletal concerns are called orthopedic devices. The orthopedic devices market is driven by the huge burden of the geriatric population is imposing the occurrence of osteoporosis, osteoarthritis, and fracture issues. These cases are further assisting in the advances in robotic-assisted surgery with expanded accuracy, 3D printing evolves custom implants, smart implants facilitate real-time patient data, AR aids surgical planning, and biologics foster tissue regeneration.

Market Scope:

| Metric | Details | |

| Market Size in 2025 | USD 65.8 Billion | |

| Projected Market Size in 2034 | USD 96.45 Billion | |

| CAGR (2025 - 2034) | 4.34 | % |

| Leading Region | North America Share by 47% | |

| Market Segmentation | By Product, By End-Use, By Region | |

| Top Key Players | Alphatec Scientific, DePuy Synthes, Fusion Orthopedics USA LLC, Group FH ORTHO, Johnson & Johnson, Madison Ortho, Medtronic, Miraclus Orthotech, Stryker Corporation, UPM Biomedicals, Zimmer Biomet | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Prominent Drivers in the Orthopedic Devices Market?

As mentioned above, the contribution of a growing aging population, several orthopedic issues, and other higher rates of sports participation and accidental injuries are leading to the wider requirement for orthopedic implants and surgical procedures for repair and stabilization. Whereas, ongoing innovations in materials, especially biocompatible titanium alloys and bioabsorbable polymers, are supporting the development of more efficient and customized orthopedic devices. The globe is shifting towards the greater adoption of minimally invasive procedures, which supports the expansion of transformations in orthopedic devices.

What are the Key Trends in the Orthopedic Devices Market?

A major factor, such as the ongoing investments in orthopedic care and the evolution of advanced technologies, like AI, is bolstering the immersion of novel efforts in the market.

- In September 2025, Joint Ai, an AI-enabled triage platform, secured a $315,000 investment from the Richard King Mellon Foundation to assist the increasing demand for orthopedic care.

- In August 2025, OIC International (USA), Medi Mold, part of the Andhra Pradesh Medtech Zone (AMTZ) (India), and AddUp, a subsidiary of Fives Group (France), collaborated to develop an advanced orthopaedic implant manufacturing facility driven by 3D printing and precision engineering.

- In January 2025, Drexel University selected Ultrafix, a Drexel-affiliated orthopedic medical device startup, to receive support from its Innovation Fund of $150,000 to accelerate orthopedic product approaches.

What is the Emerging Challenge in the Orthopedic Devices Market?

A major limitation in the respective market is the arising infection, implant loosening, and the requirement for revision surgeries can deter adoption and negatively impact producer credibility. Alongside, a need for higher spending on well-sophisticated technologies and implants, which are utilized in hip and knee replacements or robotic-assisted surgeries.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

Why did North America Dominate the Market in 2024?

In 2024, North America accounted for the biggest share of the orthopedic devices market. This regional market is fueled by a rise in participation in sports and physical activities, along with evolving severe road accidents, which ultimately result in more fractures, ligament damage, and soft tissue injuries. This further boost demands for orthopedic intervention and devices. The US has contributed its efforts in the integration of technologies, particularly robotic assistance, AI for treatment planning, and 3D printing for tailored implants, comprising a groundbreaking 3D-printed artificial knee implant and 3D-printed spinal implants.

For instance,

- In August 2025, OIC International (USA), Medi Mold, part of the Andhra Pradesh Medtech Zone (AMTZ) (India), and AddUp collaborated to develop India’s most advanced orthopaedic implant manufacturing facility, led by 3D printing and accurate engineering.

What Made the Asia Pacific Grow Significantly in the Market in 2024?

In the future, the Asia Pacific is estimated to witness rapid expansion in the orthopedic devices market. The expanding disposable income and healthcare expenditure are assisting in making more sophisticated orthopedic treatments with enhanced accessibility. Also, this spending is powered by the escalating awareness regarding musculoskeletal health among the population. Whereas India & Thailand are exploring their orthopedic medical tourism by facilitating highly advanced and affordable solutions. Recently, RSLSteeper has innovated 3D-printed prosthetics for limb loss and deformities, and established lightweight, durable braces and splints.

For instance,

- In July 2025, Straits Orthopaedics (Mfg) Sdn Bhd, a leading Malaysia-based contract manufacturer specialising in the precision machining of orthopaedic implants and surgical instruments, acquired Medin Technologies, Inc., a US-based manufacturer of sterilisation cases and trays for the orthopaedic sector, to strengthen both its product offerings and global manufacturing capabilities.

Download the single region market report @ https://www.towardshealthcare.com/price/5721

Orthopedic Devices Market: Government Initiatives in 2025

| Country | Regulatory Body | Initiatives |

| U.S. | US FDA (Food and Drug Administration) | The Breakthrough Devices Program supports patients and healthcare providers to acquire timely access to devices that enable more efficient treatment or diagnosis for life-threatening or irreversibly debilitating diseases. |

| China | NMPA (National Medical Products Administration) | In April 2025, "Implementation Rules for the Special Review of Innovative Medical Devices" were explored to boost market access for technologies that address urgent clinical needs. |

| Japan | Japanese Government under the Pharmaceuticals and Medical Devices (PMD) Act | Sponsored the "Japan Health" exhibition as a side event for Expo 2025 in Osaka, to expand business opportunities in medical devices and regenerative medicine. |

| India | Indian Government Led by CDSCO | Developed a 3D printing hub for orthopedic implants, in collaboration with the Orthopedic Implant Coalition (OIC) and Medical Mold, which was introduced at the Andhra Pradesh MedTech Zone (AMTZ) in August 2025. |

Segmental Insights

By product analysis

Which Product Held a Major Share of the Orthopedic Devices Market in 2024?

The joint replacement/orthopedic implants segment registered dominance in the global market in 2024. The segment is fueled by the accelerating rates of osteoarthritis, osteoporosis, and degenerative joint diseases, and the globe is moving towards minimally invasive surgery (MIS) techniques. This further enables the adoption of sophisticated joint replacement approaches. The market is stepping into the transformation of 3D printing for enhanced patient-specific fits; developments in materials, especially specialized ceramics and metal alloys, for expanded durability and biocompatibility.

Besides this, the orthobiologics segment is predicted to expand at a rapid CAGR. Osteoarthritis prevalence is widely demanding viscosupplements and cellular therapies are applied in the management of pain and restoring function in affected joints. Ongoing studies are emphasizing adipose-derived stem cells (AD-MSCs) and stromal vascular fraction (SVF), which possess promising effects in natural healing processes. The therapeutic side of exosomes (small vesicles secreted by cells) and microRNAs (miRNAs) is supporting the regulation of cellular processes and boosting healing.

By end-use analysis

Why did the Hospitals Segment Lead the Market in 2024?

The hospitals segment accounted for a dominant share of the global orthopedic devices market in 2024. Well-developed hospital encompasses sophisticated equipment and advanced surgical technologies, along with a greater concentration of well-trained professionals and specialized surgeons. Additionally, hospitals are providing suitable reimbursement policies for orthopedic procedures, which are unaffordable for certain patient populations. Various companies are reaching these kinds of hospitals for further product testing, clinical trials, and training initiatives for surgeons.

On the other hand, the outpatient facilities segment is anticipated to grow at the fastest CAGR in the coming era. The increasing adoption of minimally invasive surgery (MIS), technological advances, and economic benefits for patients and healthcare providers are supporting the segmental and global market growth. The emergence of non-surgical modalities, especially extracorporeal shockwave therapy, cryotherapy, and pulsed signal therapy, is used to boost recovery without the risks of surgery.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments in the Orthopedic Devices Market

- In September 2025, Croom Medical, a CDMO specialising in orthopedic implant technology, launched Biofuse™, a 3D-printed porous ingrowth platform designed with Laser-Powder-Bed-Fusion (L-PBF) technology.

- In April 2025, THINK Surgical, Inc., a pioneer in the field of orthopedic surgical robots, officially introduced the successful first use of Maxx Orthopedics' Freedom Total Knee implant using the TMINI Miniature Robotic System.

- In March 2025, Zimmer Biomet Holdings, Inc., a global medical technology leader, received clearance of Persona Revision SoluTion Femur, a revision knee implant component facilitating an alternative for patients with sensitivities to certain metals.

- In January 2025, Group FH ORTHO, a global player in orthopedic prosthetic technologies, unveiled JARVIS, its new round baseplate for reverse shoulder prostheses in the USA.

Browse More Insights of Towards Healthcare:

The medical device CMO and CDMO market is witnessing strong growth, with revenue expected to surge significantly, potentially reaching hundreds of millions between 2025 and 2034.

The global Class C and Class D medical devices market was valued at US$ 55.13 billion in 2024, is expected to rise to US$ 69.52 billion in 2025, and could nearly reach US$ 559.55 billion by 2034, reflecting a CAGR of 26.12%.

The electrosurgical devices market is projected to grow from US$ 7.19 billion in 2024 to US$ 7.45 billion in 2025, reaching approximately US$ 10.21 billion by 2034, at a CAGR of 3.57%.

The anesthesia devices market is set to expand from US$ 17.52 billion in 2024 to US$ 19.04 billion in 2025, ultimately reaching around US$ 40.16 billion by 2034, with a CAGR of 8.65%.

The intranasal drug delivery devices market is estimated at US$ 1.74 billion in 2024, expected to grow to US$ 1.91 billion in 2025, and projected to reach US$ 4.54 billion by 2034, expanding at a CAGR of 10.04%.

Similarly, the pharmacy automation devices market is anticipated to grow from US$ 7.6 billion in 2024 to US$ 8.37 billion in 2025, reaching roughly US$ 19.9 billion by 2034, at a CAGR of 10.1%.

The continuous blood pressure monitoring devices market is also on a strong growth trajectory, expected to generate substantial revenue over the forecast period from 2025 to 2034.

The smart medical devices market is projected to rise from US$ 24.82 billion in 2024 to US$ 26.62 billion in 2025, reaching about US$ 49 billion by 2034, at a CAGR of 7.26%.

The insulin drugs and delivery devices market is estimated at US$ 23.75 billion in 2024, growing to US$ 25.58 billion in 2025, and expected to reach US$ 49.18 billion by 2034, at a CAGR of 7.65%.

The digital health monitoring devices market is set to expand rapidly, rising from US$ 5.23 billion in 2024 to US$ 6.22 billion in 2025, and is projected to reach US$ 29.71 billion by 2034, growing at a robust CAGR of 18.9%.

Orthopedic Devices Market Key Players List

- Alphatec Scientific

- DePuy Synthes

- Fusion Orthopedics USA LLC

- Group FH ORTHO

- Johnson & Johnson

- Madison Ortho

- Medtronic

- Miraclus Orthotech

- Stryker Corporation

- UPM Biomedicals

- Zimmer Biomet

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/5721

Segments Covered in the Report

By Product

- Joint Replacement/Orthopedic Implants

- Lower Extremity Implants

- Knee Implants

- Hip Implants

- Foot & Ankle Implants

- Spinal Implants

- Dental

- Dental Implants

- Craniomaxillofacial Implants

- Upper Extremity Implants

- Elbow Implants

- Hand & Wrist Implants

- Shoulder Implants

- Lower Extremity Implants

- Orthobiologics

- Viscosupplementation

- Demineralized Bone Matrix

- Synthetic Bone Substitutes

- Bone Morphogenetic Protein (BMP)

- Stem Cell Therapy

- Allograft

- Trauma

- Implants

- Accessories (Plates, Screws, Nails, Pins, Wires)

- Instruments

- Sports Medicine

- Body Reconstruction & Repair

- Accessories

- Body Monitoring & Evaluation

- Body Support & Recovery

- Others

By End-Use

- Hospitals

- Outpatient Facilities

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5721

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.