Silicon Anode Battery Market Size Worth USD 20,799.74 Million by 2034 Driven by EV Demand and Advanced Material Innovations

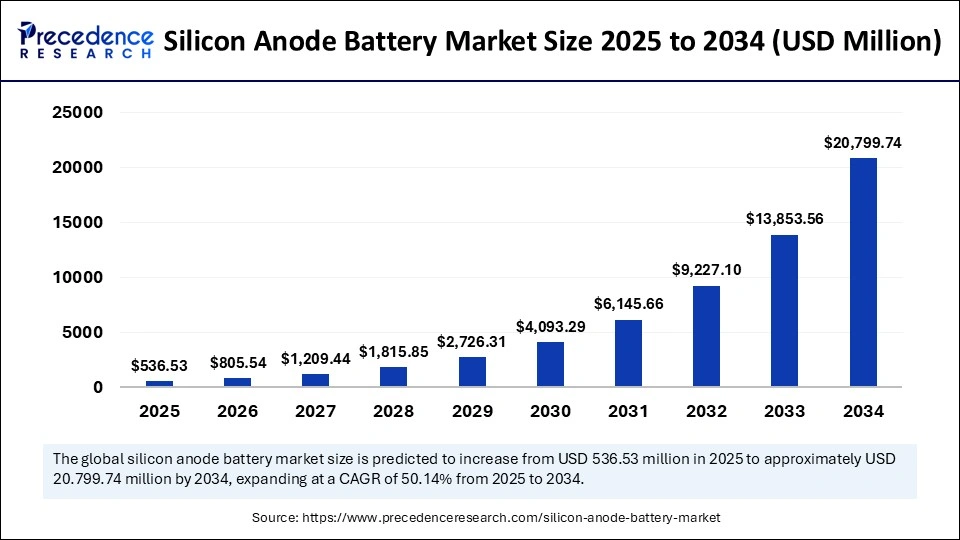

According to Precedence Research, the global silicon anode battery market size will grow from USD 536.53 million in 2025 to nearly USD 20,799.74 million by 2034, with an expected CAGR of 50.14% from 2025 to 2034. Innovations in silicon materials and rising demand for high-density batteries are driving adoption across EVs, electronics, and energy storage

Ottawa, Sept. 11, 2025 (GLOBE NEWSWIRE) -- The global silicon anode battery market size is expected to be worth over USD 20,799.74 million by 2034, increasing from USD 536.53 million in 2025 and is growing at a strong CAGR of 50.14% from 2025 to 2034. The silicon anode battery market growth is driven by technological advancements in silicon anode materials.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/6173

Silicon Anode Battery Market Highlights

- In terms of revenue, the silicon anode battery market was valued at USD 357.35 million in 2024.

- It is projected to exceed over USD 20,799.74 million by 2034.

- The market is expected to expand at a significant CAGR of 50.14 % from 2025 to 2034.

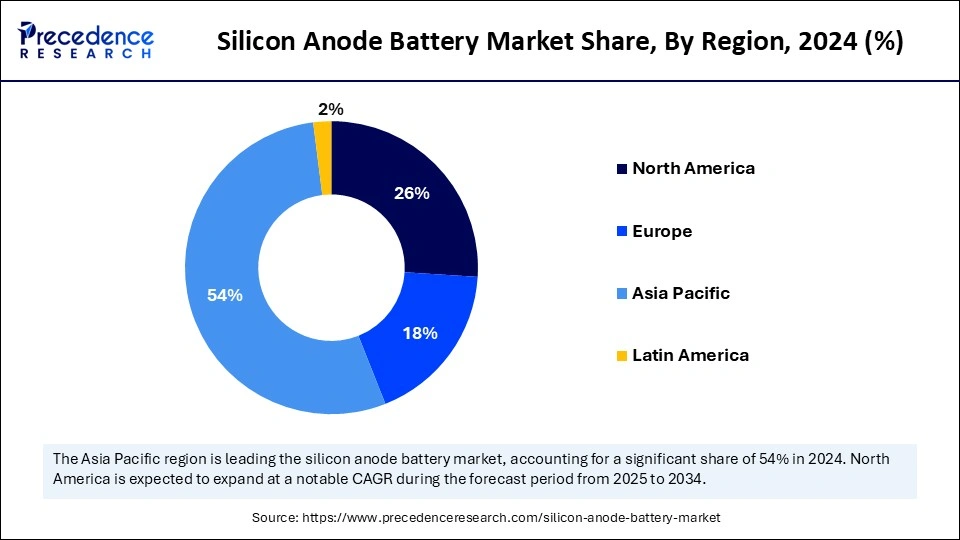

- Asia Pacific accounted for the largest market share of 54% in 2024.

- North America is predicted to expand at the fastest CAGR during the forecast period.

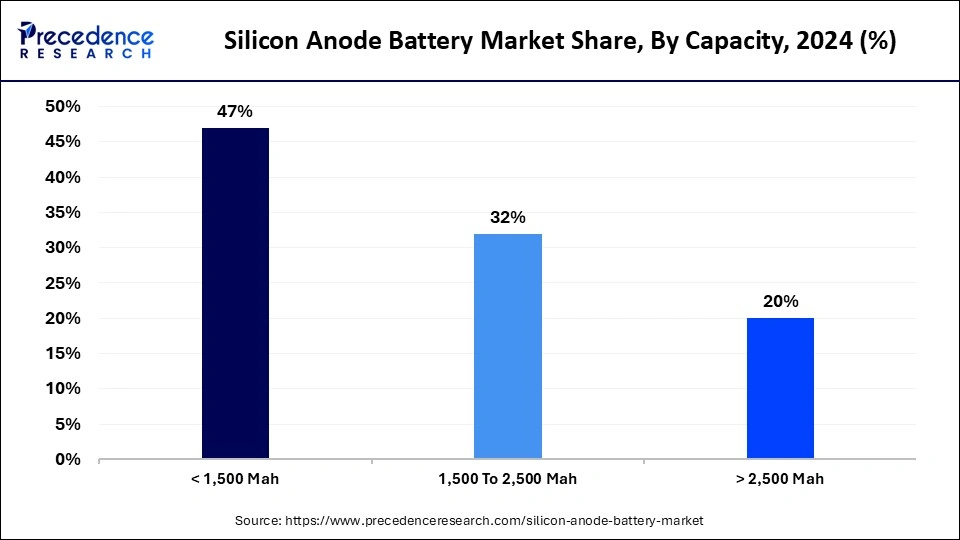

- By capacity, the <1,500 mAh capacity segment contributed the highest market share in 47% in 2024.

- By capacity, the 1,500 to 2,500 mAh segment is expected to grow at the fastest CAGR in the coming years.

- By application, the automotive segment generated the major market share of 38% in 2024.

- By application, the energy & power segment is expected to grow at a significant CAGR during the forecast period.

Silicon Anode Battery Market Overview

What is a Silicon Anode Battery?

The silicon anode battery market refers to the production, distribution, and use of silicon anode batteries, in which a silicon anode is a component of a lithium-ion battery, where silicon is used as the primary material to store lithium ions during the battery’s charge cycle. Silicon batteries are a new kind of battery cell, which comes with silicon anodes instead of graphite anodes instead of the graphite anodes which power the more traditional Lithium-Ion batteries.

These batteries have higher energy density, which basically means they can hold more power than standard batteries in the same space. Silicon is more resilient to these volume changes and exhibits less degradation over many charge cycles. As a result, lithium-ion batteries tend to have a longer lifespan, maintaining more of their original capacity for longer periods. Lithium-silicon batteries also provide improved thermal stability.

Silicon Anode Battery Market Trends

-

Smartphone Adoption on the Rise

Leading manufacturers like TDK are accelerating rollout of third-gen silicon anodes for flagship smartphones, boosting adoption in ultra-thin devices.

-

Increasing EV & Energy Storage Demand

Silicon anodes are being rapidly adopted in electric vehicles and renewable energy storage systems due to their higher energy density and faster charging capabilities.

-

Consumer Electronics & IoT Expansion

Wearables, smart devices, and IoT applications are leveraging silicon anode batteries for longer life and compact form factors.

-

Advanced Material Innovations

Innovations in nanostructuring, composite anodes (e.g., silicon-carbon), and self-healing binders are improving stability and addressing silicon's swelling issues.

Silicon Anode Battery Market Applications

-

Electric Vehicles (EVs): Used to significantly increase energy density and range in electric cars, buses, and trucks.

-

Consumer Electronics: Enable longer battery life and faster charging in smartphones, laptops, tablets, and wearables.

-

Energy Storage Systems (ESS): Applied in residential, commercial, and grid-level storage for renewable energy integration and load balancing.

-

Aerospace and Drones: Provide lightweight, high-capacity power solutions for drones, satellites, and unmanned aerial vehicles (UAVs).

-

Medical Devices: Support compact, long-lasting power for portable medical equipment such as hearing aids and wearable monitors.

- Power Tools: Deliver high-discharge energy storage for cordless tools requiring strong bursts of power.

➤ Get the Full Report @ https://www.precedenceresearch.com/silicon-anode-battery-market

Silicon Anode Battery Market Opportunity

Innovation and Implementation of AI-powered Materials

AI-powered material optimization is a major opportunity for the silicon anode battery market. AI-powered material optimization includes battery cells that degrade over time, reducing their capacity and performance. AI-driven BMS systems mitigate this by improving charging cycles and preventing cells from operating outside safe limits. This extends battery life and also reduces replacement costs.

Artificial intelligence (AI) algorithms mostly concentrate on battery health and performance, and machine learning (ML) algorithms concentrate on real-time data, improving charging and discharging cycles for effectiveness. Optimized battery charging is designed to reduce the wear on the battery and improve its lifespan by reducing the time. AI is used to optimize systems, improve production, reduce costs, raise efficiency, enhance uptime, cut emissions, and improve safety.

Silicon Anode Battery Market Challenge

What are the Limitations of the Silicon Anode Battery Market?

Balancing performance and cost are the major concerns in the silicon anode battery market. Balancing performance and cost disadvantages includes overspending on performance can threaten financial health; achieving balance requires strategic decision-making and ongoing evaluation.

Cost-effectiveness analysis will almost always include a series of assumptions, as it is generally not possible to measure everything necessary for a comprehensive analysis. Limitations of the benefit-cost ratio include that it does not indicate the project’s size or provide a specific value on what the asset/ project will generate, and the reliability of the BCR depends heavily on assumptions.

Check Comprehensive Report@ https://www.precedenceresearch.com/silicon-anode-battery-market

Silicon Anode Battery Market Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 357.35 Million |

| Market Size in 2025 | USD 536.53 Million |

| Market Size in 2031 | USD 6,145.66 Million |

| Market Size by 2034 | USD 20,799.74 Million |

| Growth Rate 2025 to 2034 | CAGR of 50.14% |

| Leading Region in 2024 | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capacity, Application, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players Covered | XG Sciences, Enevate Corporation, ENOVIX Corporation, Amprius technologies, Huawei, OneD Material, Inc., Nexeon Ltd, California Lithium Battery, EoCell Inc., and Group14 Technologies. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Silicon Anode Battery Market Outlook

How Big is the Asia Pacific Silicon Anode Battery Market?

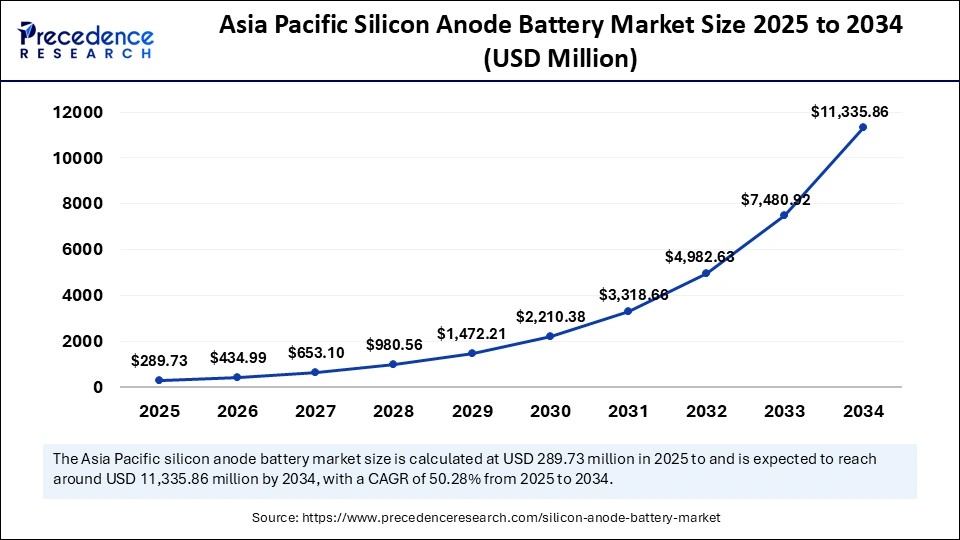

Asia Pacific silicon anode battery market size was evaluated at USD 192.97 million in 2024 and is predicted to surpass around USD 11,335.86 million by 2034, at a CAGR of 50.28% from 2025 to 2034.

Asia Pacific dominated the silicon anode battery market in 2024. Technological innovation in silicon anode materials, government regulations & initiatives, declining battery costs, rising demand for high-energy density batteries, and the growing electric vehicle market are driving the growth of the market in the Asia Pacific region.

- In May 2025, to develop advanced silicon-carbon anode materials for lithium-ion batteries, Himadri Specialty Chemical Ltd, a chemical manufacturing company, collaborated with Sicona Battery Technologies Pty, Ltd, an Australian battery materials company. The collaboration grants Himadri the rights to access, localize, and commercialize Sicona’s Silicon Carbon (SiCx®) anode technology in India.

India & China: Major Contributors to the Silicon Anode Why is North America the Fastest Growing in the Silicon Anode Battery Market?

India and China are emerging as key players in the rapidly growing Silicon Anode Battery Market, each following distinct yet ambitious trajectories. China currently leads the global market with a dominant share, driven by its strong electric vehicle (EV) adoption, high consumer electronics demand, and government-backed initiatives to scale clean energy technologies. The country has significantly invested in R&D, large-scale manufacturing, and advanced material innovation, positioning itself as a global hub for silicon anode battery production.

India, on the other hand, is in the early stages of development but showing exceptional growth potential. It is the fastest-growing market in the Asia-Pacific region, with domestic startups and manufacturers beginning to invest in silicon-carbon anode technologies. New manufacturing facilities are being planned to support local EV demand, reduce dependency on imports, and position India as a competitive player in the global battery supply chain.

North America Silicon Anode Battery Market Trends:

North America is anticipated to grow at the fastest rate in the market during the forecast period. Extended battery life for smartphones, drones, and wearables, faster charging cycles, higher range for electric vehicles (EVs), AI-powered material optimization, and solid-state battery integration are gaining momentum, contributing to the growth of the silicon anode battery market in North America.

Silicon Anode Battery Market Segmentation

Capacity Outlook

Why did the <1,500 mAh segment dominate the Silicon Anode Battery Market?

The <1,500 mAh segment held a dominant presence in the market in 2024. A 1500 mAh battery can power an electronic device with a draw of 1mA for 1500 hours, or a device that draws 1.5 A for one hour. A battery has a capacity of 1500 mAh at 3.7V; the voltage can range from 4.2V when fully charged to 3.0V when completely discharged. Using a battery with a lower mAh rating than recommended for a device may result in shorter usage time between charges. It may not provide sufficient power to meet the device’s needs, leading to more frequent recharges.

The 1,500 to 2,500 mAh segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The high capacity of 2500 mAh batteries ensures long-lasting performance and reduces the need for frequent replacements. A higher mAh rating suggests a larger battery capacity, which can potentially result in longer battery life for a device.

Application Outlook

Which application segment held the largest share of the Silicon Anode Battery Market?

The automotive segment dominated the market in 2024. Automotive applications of the silicon anode battery technology have rapidly advanced in the past decade. The rising demand for high-energy, low-cost battery technology leads to significant investment from companies seeking to meet Original Equipment Manufacturer (OEM) needs, along with safety needs. This demand is driven by the global shift towards electrification in the automotive industry, aiming to reduce carbon emissions and dependence on fossil fuels. Electric vehicles (EVs) are rapidly proliferating, prompting a race to develop more effective and powerful battery technologies.

The energy & power segment is expected to grow at a significant CAGR during the forecast period. Silicon anode battery improvement contributes to an increased energy density, significantly reduces volumetric expansion, and minimizes capacity degradation. Silicon anodes can also reduce charge times and increase power output across many applications.

Case Study: Amprius Technologies and Airbus – Extending Flight Endurance with Silicon Anode Batteries

One of the most notable real-world demonstrations of silicon anode battery technology comes from Amprius Technologies, a U.S.-based leader in silicon nanowire anode innovation. Their work with Airbus on the Zephyr High-Altitude Pseudo-Satellite (HAPS) program provides a compelling example of how silicon anodes are already reshaping high-performance applications.

The Challenge: Energy Limitations in Long-Endurance Flight

Unmanned aerial vehicles (UAVs) and HAPS systems are designed to operate at stratospheric altitudes for extended durations, often weeks at a time. These platforms are critical for missions such as:

- Climate and environmental monitoring

- Defense surveillance

- Rural communication connectivity

However, conventional graphite-based lithium-ion batteries posed significant limitations. Their lower energy density restricted flight endurance, forcing frequent landings or reducing mission scope. Weight was another barrier—every additional gram of battery reduced the payload capacity of the aircraft.

The Solution: 100% Silicon Nanowire Anodes

Amprius introduced its 100% silicon nanowire anode batteries, which deliver up to 450 Wh/kg energy density and 1,150 Wh/L volumetric energy density—nearly double the performance of traditional lithium-ion cells. Unlike bulk silicon, which suffers from expansion and degradation, nanowire architecture accommodates volume changes without breaking down, ensuring long cycle life and stability.

By replacing graphite with this advanced anode design, Amprius batteries significantly increased the amount of energy that could be stored in the same physical space while keeping the system lightweight.

The Result: Record-Breaking Flight Performance

In field demonstrations, the Airbus Zephyr HAPS equipped with Amprius batteries achieved record-breaking endurance, staying airborne for more than 60 days continuously. This milestone showcased how silicon anode technology can extend flight time, reduce downtime, and enable new mission capabilities that were previously impossible with conventional batteries.

Why It Matters for the Market

This case highlights several important lessons for the global silicon anode battery market:

- Validation of commercial viability – Silicon anodes are no longer just a lab innovation; they are already powering critical missions.

- Scalability across industries – While aerospace provides a niche, high-performance use case, the same benefits—higher energy density, longer cycle life, and reduced charging times—are directly transferable to electric vehicles, consumer electronics, and grid storage.

-

Proof of industry collaboration – Partnerships like Amprius and Airbus illustrate how battery manufacturers and end-users must collaborate to accelerate adoption.

This case study demonstrates that silicon anode batteries are not simply a theoretical “next-gen” technology. They are already redefining performance standards in one of the most demanding sectors, providing a blueprint for how the technology will scale into automotive, energy, and consumer markets over the next decade.

Silicon Anode Battery Market Top Companies

The Silicon Anode Battery Market is dominated by key industry leaders whose strong market share and strategic initiatives shape the future direction of the industry.

-

Group14 Technologies: Develops advanced silicon-carbon composite anode materials (Silicon Carbon SCC55™) designed to deliver higher energy density for EVs and consumer electronics.

-

EoCell Inc.: Specializes in high-performance silicon anode battery technologies optimized for electric vehicles and next-gen mobile power systems.

-

California Lithium Battery: Focuses on producing high-capacity silicon-graphene composite anodes, aiming to extend battery life and improve charging speeds.

-

Nexeon Ltd.: UK-based company pioneering engineered silicon materials that reduce battery swelling and improve cycle stability in lithium-ion batteries.

-

OneD Material, Inc.: Offers SINANODE™ technology, which grows silicon nanowires directly onto graphite to significantly enhance lithium battery performance.

-

Huawei: Integrates silicon-based anode technology in its consumer electronics and is investing in next-generation battery R&D for faster-charging smartphones and wearables.

-

Amprius Technologies: Manufactures ultra-high energy density lithium-ion batteries using 100% silicon nanowire anodes, ideal for aviation, drones, and defense applications.

-

ENOVIX Corporation: Produces 3D-structured silicon anode lithium-ion batteries that offer higher energy density and improved safety for portable electronics.

-

Enevate Corporation: Delivers silicon-dominant battery technology with ultra-fast charging and high energy density tailored for electric vehicles.

- XG Sciences: Develops graphene-enhanced silicon anode materials that aim to boost performance while maintaining long cycle life and structural integrity.

Silicon Anode Battery Market Recent Developments

- In August 2025, research into anode material based on silicon and tin sulphide was launched by AIT (Austrian Institute of Technology), which is working on a material mix that combines the high specific capacity of silicon with the electrical conductivity of tin compounds. (Source: AIT launches research into anode material based on silicon and tin sulphide - electrive.com)

- In April 2025, silicon anode materials for lithium-ion batteries in EVs, electronics, and energy storage systems were launched, NBMSiDE P-300N Silicon anode product by NEO Battery Materials, a Canadian battery materials technology company. (Source: Charged EVs | NEO launches silicon anode material for EV batteries - Charged EVs)

- In July 2025, the launch of the AI-1 platform, its Artificial Intelligence Class batteries for the next generation of mobile smartphones that need significantly higher total energy and power to perform AI functions locally, was announced by Enovix Corporation, a leader in advanced silicon battery technology. (Source: Enovix Launches AI-1™: A Revolutionary Silicon-Anode)

Silicon Anode Battery Market Segments Covered in the Report

By Capacity

- <1,500 mAh

- 1,500 to 2,500 mAh

- >2,500 mAh

By Application

- Automotive

- Consumer Electronics

- Energy & Power

- Medical Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/6173

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Battery Binders Market: Explore how innovative binders are enhancing lithium-ion performance and lifecycle

➡️ Electric Vehicle Battery Market: Examine how EV adoption and fast-charging needs are fueling demand

➡️ Silicone in Electric Vehicles Market: Understand why silicone materials are critical for EV safety and efficiency

➡️ Silicon Carbide Semiconductor Devices Market: Track how SiC devices are powering next-gen EVs and renewable energy systems

➡️ Advanced Battery Market: Analyze breakthroughs in solid-state, flow, and next-gen chemistries

➡️ Sustainable Battery Raw Materials Market: See how ethical sourcing and recycling are shaping the green supply chain

➡️ Flexible Battery Market: Discover how wearables and IoT are driving demand for ultra-thin power solutions

➡️ Lithium-Ion Battery Market: Assess market dominance and challenges in scaling EV and ESS capacity

➡️ Battery Technology Market: Gain insights into global innovation trends shaping energy storage

➡️ Battery Materials Market: Learn how cathodes, anodes, and electrolytes are evolving with next-gen batteries

➡️ Electric Vehicle Battery Swapping Market: Examine how swapping stations are reshaping EV charging infrastructure

➡️ Lithium-Ion Battery Recycling Market: Explore how circular economy practices are unlocking critical materials

➡️ IoT Battery Market: Track how smart sensors and connected devices are shaping new power demands

➡️ High Voltage Battery Market: Analyze adoption in EVs and industrial applications requiring robust power

➡️ Electric Vehicle Battery Recycling Market: Understand how recycling is critical to supply chain resilience in EVs

➡️ Advanced Lead-Acid Battery Market: Discover modernization efforts keeping lead-acid relevant in niche uses

➡️ Sodium-Ion Batteries Market: Examine why sodium-ion is emerging as a cost-effective alternative to lithium

➡️ Traction Battery Market: Understand how traction batteries are powering EVs, forklifts, and rail transport

➡️ Smart Battery Market: Learn how AI-driven monitoring and BMS are redefining efficiency and safety

➡️ Metal-Air Battery Market: Analyze potential breakthroughs in ultra-high energy density storage

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.